Mexico is a place of many advanced Amerindian civilizations. It is a country rich in history with populations who still hold and cherish the values taught by their ancestors. The modern period began early in the 19th century with a revolt organized by priest Miguel Hidalgo on September 16th 1810 which is now known as Mexico’s Independence Day. The devaluation of their currency in 1994 threw Mexico into an economic recession not seen in over half a century. They continue to make an impressive recovery even with the presence of low wages, high unemployment rates, and a high gini index. I will use this project to disclose the current and past political and economic position of the country, while at the same time relating it to global business.

Culture

Mexico is home to some of the earliest and most advanced civilizations of the western hemisphere. This area in Latin America was formerly known as Mesoamerica, a tern that refers to the geographic area and cultural traditions of the pre-Colombian civilizations. There are many native cultures that have their roots planted in Mexico, but there are six that are considered to have been the most influential; the Olmecs, Teotihuacans, the Toltecs, the Mayans, the Zapotex/Mixtecs, and the Aztecs. Each one of these civilization existed in their own geographical area and traces of the original civilizations are still being uncovered today. The Mexican culture is interesting mix of Native American traditions and Spanish colonial influences. The official and predominant language is Spanish and is spoken by nearly the entire population. However, there also exist dozens of indeginous languages although spoken by few in comparison. One thing the Mexican culture is known for is the unified nature of the family. The country’s divorce rate is among the lowest in the world, and children usually live with their parents until they marry. The culture is predominately patriarchal with the father acting as the ruler of the family and the mother being the heart that holds the family together.

Politics

Mexico is a federal republic constituting of thirty one sates and one federal district. There are three agencies that govern the country, the independent executive, legislative, and judicial branch. The chief of state who is also the head of the government is the president. The president is elected by a popular vote resulting in a six year term. There are a few political parties present in Mexico; however, the three prevailing parties are the Institutional Revolutionary Party (PRI), the National Action Party (PAN), and the Party of the Democratic Revolution (PRD). There is not one single party that holds majority in either house of congress.

Economics

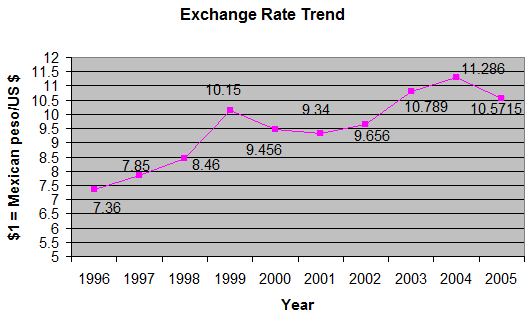

Mexico has a free market economy that recently entered the trillion dollar class. It contains a mixture if modern and outmoded industry and agriculture, increasingly dominated by the private sector (“CIA World Fact Book”). The government is phased with serious continued chronic problems such as corruption and crime. Together these two may constitute for as much as 25% of Mexico’s GDP. Continued financial problems prevent the government for doing things such as adequately subsidizing its universities or the basic research that would provide full employment for Mexican scientist and engineers, and ultimately improving the national economy (Wikipedia). In December of 1994 the Mexican government at that time headed by Ernesto Zedillo was forced to devalue the peso by 50% which eventually led to the collapse of the Mexican stock market. In an effort to address financial market imbalances, on December 22, 1994 the government allowed the peso to float and substantially raised short term interest rates. To ensure orderly conditions in foreign exchange markets with the new floating exchange rate and Exchange Stabilization Funs of US$18 billion was established with contributions from the North American Financial Agreement and from the monetary authorities from major countries and from private commercial banks (IMF). In order to receive payment Mexico had to institute cutbacks on social, infrastructural and educational spending. Accepting this money further instituted Mexico’s dependence to the United States as well as other foreign countries which some say further reduced their sovereignty. Mexico has seen annual average real growth rates of about 4.1% consistently high unemployment. There was a continued decline in the exchange rate from 2000 (9.456 Mexican pesos/US dollar) to 2004 (11.286 Mexican pesos/US dollar), however, Mexico is currently experiencing a slight increase with the present exchange rate set at 10.5715 Mexican pesos/US dollar. The graph below illustrates Mexico’s exchange rate trend for the past 10 years.

Economic Rates

One issue that has been in the area of contention in regards to Mexico’s economy has been the real impact the North American Free Trade Agreement had on Mexico’s growth rates. Mexico has been a member of NAFTA for ten years and has made some incredible developments in term of human development. Mexico has been successful in improving health and educational rates but continues to fight low and inequitable growth that has resulted in present high poverty rates. “According to 2000 date, 53 percent of the country’s population is poor (living on less than $2 per say) while close to 24 percent is extremely poor (living on less than $1 per day)” (World Bank). Policies put in place to deal with the 1994 economic crisis have helped Mexico on the road to recovery. “After a 6.2% GDP’s contraction in 1995, form 1996 onwards the Mexican economy has grown at and annual average rate higher than 5.0%, a rate not achieved during the past two decades” (Ministry of Finance). The growth rate experienced by the Mexican during this time period is higher than the world’s average and higher than any other Latin American country during that same period. Today the GDP per capita amounts to $US 9,600 which is 59% higher than just five years ago. At the moment Mexico continues to experience a decline in inflation rates. The inflation rate in 2000 was 8.96% which was an important milestone for Mexico to reach since it was the lowest it had been since 1994. The country has continued its downward inflation trend, “twelve month inflation dropped to its lowest rate of 3.05% at the end of October, well within the target of between 2 and 4 percent set by Mexico’s central bank for 2009” (Yahoo Finance). Literacy rates in the country have also experienced an increase within the last 10 years. In 1995 78.2% of the population over 15 was able to read and write. Numbers for 2010 have not yet been calculated, but as of 2003 92.2% of the population of 15 was able to read and write, a 14% increase in just eight years.

Natural Resources

The natural resources of Mexico are petroleum, silver, cooper, gold, lead, zinc, natural gas, and timber. The country is recognized as being one of the most biologically diverse places on the planet. In 1992 Mexico’s secretary of urban development and technology stated, “the costs and benefits of the use of natural resources…which annual rates of between 2% and 4.5% in tropical rain forests, must be incorporated into Mexico’s accounting” (SUDE).

FDI Inflows and Outflows

Since about 1995 foreign direct investments (FDI) in to Mexico have increased substantially. A New foreign direct investment law instituted in 1993 abolished restrictions to foreign ownership in the majority of Mexico’s economic activities. In recent years Mexico has come in second place as a leader in receiving the most FDI from any other Latin American country. In the year 2000 “by country, the United States alone account for 60.4% of FDI in the country through 11,630 subsidiary companies established in Mexico” (Ministry of Finance). The textile, garments, automotive and electronic sectors have been the largest and fastest growing investments in recent times In 2009 manufacturing alone was responsible for 77% of FDI in Mexico.

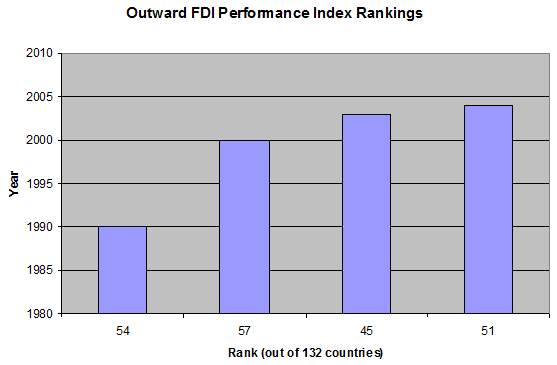

The following graph illustrates Mexico’s rank as compared to 132 other countries in the levels of FDI Outflow in the years 1990, 1995, 2000, 2005, and 2010.

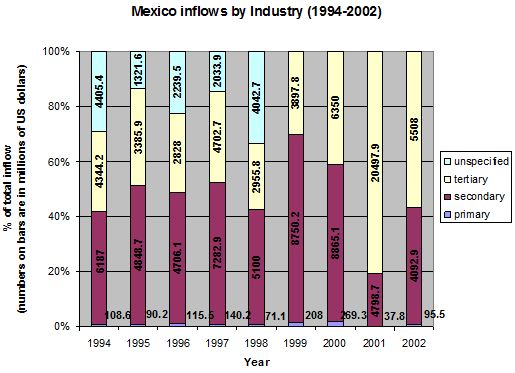

International firms are investing into Mexico primarily in regards to three different industries. The industries have been sectioned of by either being primary, secondary, or tertiary. A primary industry is considered as one that includes agriculture, hunting, forestry and fishing, mining, and or quarrying and petroleum. A secondary industry includes areas such as food, beverages and tobacco, chemicals and chemical products, metal and metal products, machinery and equipment, and any other manufacturing products. The final type of industry is what is called a tertiary industry and it includes, electricity, gas and water, construction, trade, hotels and restaurants, transport, finance, real estate, and other services. The following graph illustrates the amount of FDI allocated to ach of the three industries mentioned above from 1994 to 2002. Information has been taken from the United Nations Conference on Trade and Development website.

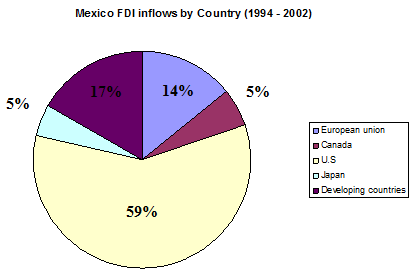

There are several countries that are investing in Mexico, with the largest of these investors being the United States. Information as to what countries are investing in Mexico are usually separated as the type of country that each is. For example countries are separated into developed or developing countries. There are many countries that fall into the developed section, but for purposes of this report I will only give information on the top four developed countries (European Union, Canada, US, and Japan). Another source of FDI for Mexico comes from developing countries. These will be grouped together in the graph to make things easier to read. Some developing countries investing in Mexico include but are not limited to, Chile, Bahamas, Cayman Islands, Panama, India, China, Korea, and Taiwan). The following graph illustrates the breakdown as to how much each country contributes to Mexico’s FDI inflow. The graph includes numbers compiled from 1994 to 2002.

Mexico’s FDI in Foreign Countries

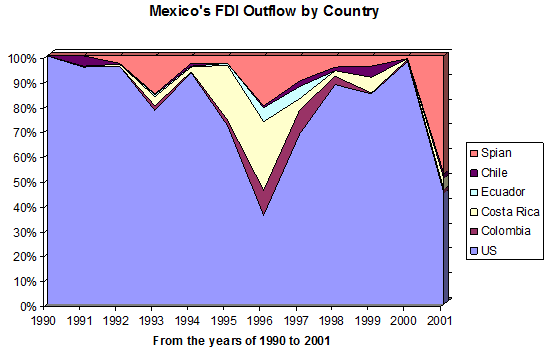

Mexico’s FDI is concentrated in the United States, but is also does some small investing in countries such as Colombia, Costa Rica, Ecuador, Spain and Chile. The graph below gives an idea in the amount it invests in foreign countries. For simplicity reasons I have chosen to provide information on only a few countries (those which receive the most FDI from Mexico).

World trade

Mexico has become a great example of trade as a vehicle for economic modernization and growth. Mexico’s overall performance over the last five years has been positive. ‘Between 1997 and 2000, GDP expanded at an annual average rate of 5.2%; Mexican trade in goods grew at an annual average rate of 17.1%, the fastest among WTO’s twenty largest single members, with imports slightly outpacing exports” (WTO). Mexico’s trade policy remains closely related with the advancement of FDI.

Trading partners

Mexico’s major trading partners are the United States, Canada, Germany, China, and Japan. Mexico has been through a significant economic transformation becoming a much more open economy welcoming free world trade. The World Trade Organization in 2000 ranked Mexico as the 8th leading exporter and the 7th leading importer. The European Union is Mexico’s second largest trading partner. The structure of the Mexican and European Union economies trade flows between the two countries tend to be paired with a high relationship in intra-industrial trade that include goods such as chemicals, cars, and electronics. “European Imports total volume in 2004 amounted to € 14,628 million mainly in machinery (27.5%); followed by energy (22.8%), transport equipment (14.7%, automotive products (12.5%), chemical products (8.3%) and agriculture products (5.6%)” (Trade Issues).

Trade Volume

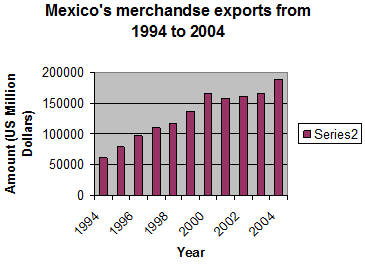

Trade volume is an indicator of how much a country depends on foreign trade. Goods that are not possible to produce locally are sought after in the international trade market. Imports reflect dependence on foreign made goods while exports a countries dependence on foreign markets that will buy their goods. A country with a high level of trade volume is an indicator that the country has a strong responsibility towards the global economy. Mexico’s merchandise exports from 1994 to 2004 are illustrated in the graph below.

Import and Export levels

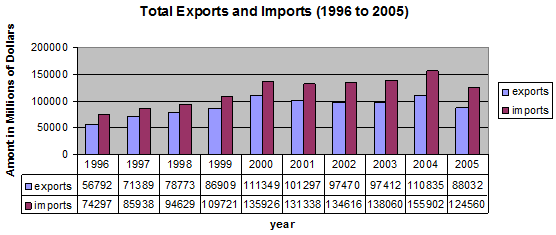

After the creation of NAFTA Mexico’s trade volumes with the United States and Canada have increased. The next step is increasing trade between Mexico and the European Union under EFTA (European Free Trade Agreement). Mexico is a producer of high quality goods in sectors such as alcoholic beverages, coffee, construction, food manufacturing, and textiles. By the same token Mexico is currently seeking investment, supplies and partners in sectors such as agriculture, airports, automotive, and communication. According to the CIA World Fact Book, exports accounted for $182.4 billion in 2004 while imports totaled $190.8 billion that same year. Mexico’s export commodities include manufactured goods, oil and oil products, silver, fruits, vegetables, coffee, and cotton. Their import commodities include metalworking machines, steel mill products, agricultural machinery, electrical equipment, and car parts for assembly. Its three most import export partners are the US (53.7%), China (7%), and Japan (5.1%).

Trade balance

Currently Mexico is running a $36.5 million dollar deficit. The following table and graph illustrate Mexico import and export levels from 1996 to 2008. Information has been taken from the U.S Census Bureau.

Current Account

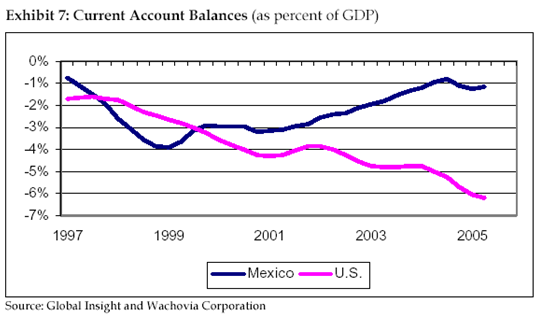

Mexico’s current account, which is made up of its services, net income, net export of goods, and net current transfers is currently suffering a $4.113 billion dollar deficit. Slow GDP growth taking place over the last few years and the historical depreciation of the peso have caused Mexico’s current account deficit to narrow. The following exhibit shows Mexico’s current account compared to that of the U.S

Attractiveness

Mexico’s new economic policies put into effect in the 1990’s have been highly successful in promotion trade and in attracting greater flows of foreign investment. The presence of free trade agreements, such as NAFTA, ant the new economic policies have made Mexico one of the most attractive countries for FDI. “Manufacturing activities have especially benefited from increased foreign capital inflows, accounting for more than 75 percent of total FDI in Mexico: 57% went to the production of metal goods; machinery and equipment; 16 percent to food and beverages, and 9% to chemicals and plastics” (Maquilaportal). Mexico’s increased attractiveness in the eyes of foreign investors may also be the result of an important skilled labor force that is young and willing to work for lower wages which attract Multinational Corporations trying to maximize profits.

Future expectations

Mexico’s economy continues to grow, inflation rates are declining and FDI inflows continue to rise. There are many signs of increasing confidence in the future. The exchange rate has just started an upward trend than can be thought to continue to improve. Foreign companies continue to view Mexico as a country of opportunities for increased profits. The Mexican government’s liberal view on free trade allows for Multinational Corporations to set up shop with minimal requirements. One of the major factors that will be playing an important part as to how well Mexico’s economy does will be based on what the U.S economy looks like in the future. Due to Mexico’s strong ties with the United States. Almost 90% of Mexican imports are destined for the United States and as much as 60% of Mexican imports come from the U.S.